Is ULTI the Next Big Weekly Income ETF? Full Review & Risk Analysis

Description

Welcome back to the channel! Today we’re breaking down one of the most talked-about new income ETFs on the market — the REX Shares IncomeMax Option Strategy ETF, ticker symbol ULTI. In this video, we cover everything you need to know, including: ✔ What ULTI is and how it works ✔ The IncomeMax strategy explained in plain English ✔ How ULTI uses dividends, option premiums, and Treasuries ✔ Why the fund targets high-volatility stocks ✔ Early weekly distribution history ✔ Portfolio construction and weighting ✔ Risk factors every investor should understand ✔ How ULTI compares to other modern income ETFs ULTI launched on October 31, 2025, and is already gaining attention for its potential to generate weekly income through a specialized, actively managed options engine. In this video, we focus on the structure, mechanics, and risk profile—without hype and without predictions. If you enjoy deep-dive ETF reviews, income strategy breakdowns, and data-driven analysis for retirees, make sure to subscribe and join the community! 📌 Disclaimer (Safe for YouTube) This content is for educational and entertainment purposes only. It is not financial advice. Always consult a licensed financial professional before making investment decisions. Past performance does not guarantee future results. 🙏 Thanks to Our Supporters A huge thank-you to all Patreon supporters, channel members, and subscribers. Your support helps keep the content coming!

Related Videos

ULTY Rebuilds After the 10:1 Reverse Split Did Anything Actually Change? Review

doug the retirement guy

Can a Treasury ETF Really Pay 12%? TLTP Explained (Data, Risks & Income Strategy)

doug the retirement guy

Yieldmax BIGY ETF Turns 1 Year Old — How Did It Perform? YieldMax Target 12 Review

doug the retirement guy

Top 8 Weekly ETF Funds High Yield + No NAV Erosion Review

doug the retirement guy

How I Built a Daily ETF Income Portfolio Using Weekly Paying ETFs

doug the retirement guy

The Hidden Weekly ETFs Nobody Talks About NOT ulty , ROUNDHILL OR YIELDMAX

doug the retirement guy

Top 7 Growth & Income ETFs in 2025 — High Yield, No NAV Erosion? Educational Breakdown

doug the retirement guy

YMAX vs WPay: Which High-Income ETF Fits Your Strategy?

doug the retirement guy

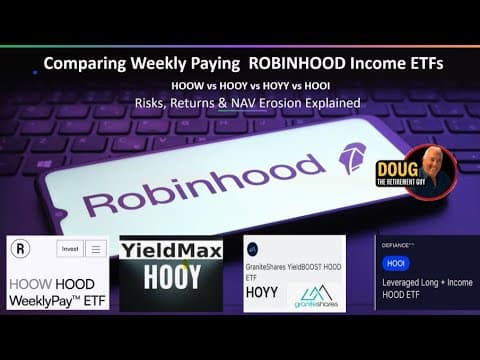

HOOW vs HOY vs HOYY vs HOOI — Which Robinhood ETF Wins for Weekly Income?

doug the retirement guy

All 16 GraniteShares Weekly Dividend ETFs Reviewed Winners, Losers & My Portfolio Results

doug the retirement guy

NEW YieldMax 25% Target Income ETFs — Full Review, Risks & What Investors Need to Know

doug the retirement guy

All 9 REC Shares Weekly Income ETFs Reviewed — Tesla, NVDA, HOII, LLII & More

doug the retirement guy