Charlie Munger’s Timeless Advice: Why $300K Is Enough to QUIT Your Job (Never Told Secret)

The Legend Investor

@thelegendinvestorrAbout

In Memory of Charlie Munger (1924–2023) A fan channel honoring the timeless wisdom and investing philosophy of one of the greatest minds in finance. Here, you’ll find: Powerful investing lessons from Charlie Munger’s lifelong partnership with Warren Buffett. Stories and insights reveal his philosophy on life, decision-making, and wealth. Practical financial wisdom to help you build prosperity—without losing peace of mind. Disclaimer This is a fan-made educational channel, not affiliated with Charlie Munger, the Munger family, Berkshire Hathaway, or any related entities. The voices you hear are digitally generated for creative, motivational and educational storytelling. They are not real, and no attempt is made to imitate, impersonate, or misrepresent any individual, living or deceased. This channel follows YouTube’s monetization and synthetic media disclosure policies in full compliance. Nothing on this channel is financial advice. Any questions: [email protected]

Latest Posts

Video Description

The “retire on $300k abroad” plan looks smart on a spreadsheet—and dangerous in real life. This talk flips the question from “What’s the minimum to stop working?” to “What actually destroys early retirements?” We cover tail risks (sequence-of-returns, currency swings, healthcare shocks, politics, isolation) and lay out a safer path: multi-stream resilience—skills, capital, health, relationships, and flexibility. What you’ll learn Why the 4% rule isn’t a law of nature How sequence-of-returns risk ruins small portfolios The hidden costs of geo-arbitrage (currency, healthcare, flights, visas) Survivorship and social proof: why the success stories are loud and the failures are silent A real independence model: multiple income streams + bigger buffer + better systems The “12-inch hurdle” mindset vs. “2-inch minimums” Key ideas Freedom isn’t cheap living; it’s antifragility. If a plan only works when everything goes right, it’s a bad plan. Build capability first: skills, capital, health, relationships. Say no to fragile independence; say yes to durable options. Chapters 00:00 The seductive $300k myth 01:52 Inversion: study failures, not headlines 04:10 The 4% rule—assumptions and blind spots 06:25 Sequence-of-returns risk (with simple math) 09:05 Currency, inflation, and forced frugality 11:18 Healthcare reality after 50 13:20 Psychology: isolation, envy, and coping spend 15:40 The survivorship bias trap 17:05 The real target: 750k–$1.5M + $20–50k/yr skills 19:25 Multi-stream, antifragile independence 21:10 The 12-inch hurdle mindset 22:30 A practical checklist for safety 24:10 Final takeaway: build capability, then choose freedom Practical checklist Buffer capital first; minimums are traps Build a location-independent skill that can earn $20–50k/yr Keep fixed costs low; avoid debt Invest in prevention: sleep, training, screenings Maintain real relationships (not just expat acquaintances) Plan for tails: crash, illness, currency, relocation Disclaimer: This is a fan-made educational production created for motivational and inspirational purposes. The narration uses a digitally produced voice for storytelling and reflection — it is not an authentic recording or real speech by Charlie Munger.

Invest Like a Pro: Munger's Essentials

AI-recommended products based on this video

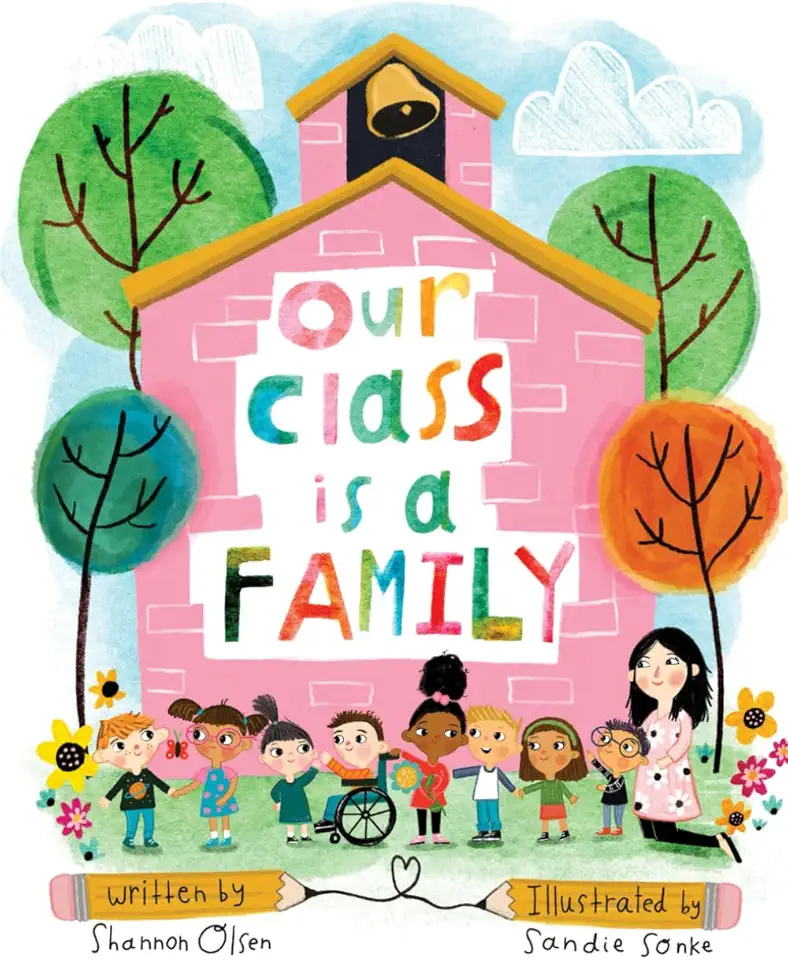

Our Class is a Family